Your Investment Strategy.

Enhanced by AI.

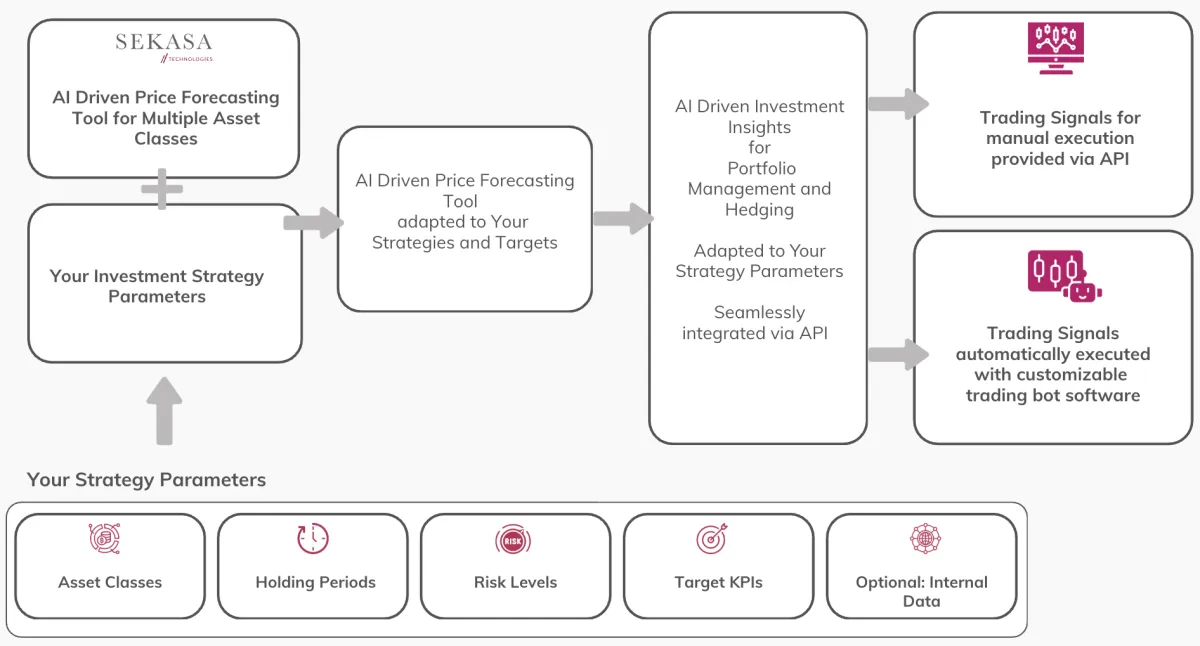

AI-powered price and volatility forecasting tool across multiple asset classes,

customized to your investment strategy.

Explore how SEKASA FIN can empower your investment and trading business -

in just a 2-minute introduction video.

Explore how SEKASA FIN can empower your investment and trading business

in just a 2-minute introduction video.

SEKASA’s AI Driven Price & Volatility Prediction Tool

Created for

Family Offices, Asset Manager, Fund

Manager, Professional Trader and

Trading Platforms

Designed to

provide AI driven investment insights on the level of institutional quant trader, without the need for internal quant ressources

Built to

be adapted to your investment strategies & to be seamlessly integrated into existing systems

The question is not whether AI will change trading. It’s whether you’ll use it or compete against those who do.

SEKASA's believe:

There is No One Perfect AI Model

That’s why our tool combines the power of over 1,500 advanced machine learning algorithms with comprehensive market data from over 50 Data APIs to deliver accurate price forecasts tailored to your specific needs.

Customizable

Forecasting Tool

We tailor our tool and its prediction models to your specific investment strategy and risk tolerance with adjustable parameters and timeframes.

Real-Time

Market Analysis

Access instant AI-Driven market insights with continuous data processing that adapts to changing market conditions and emerging trends.

Multi-Timeframe

Predictions

Receive forecasts across different time horizons, suiting to your Strategy, from intraday movements to long-term market trends.

Custom

Integration

Our AI tool seamlessly integrates via API

into your existing trading infrastructure

and workflows.

Automated

Trading Strategies

Our Tool executes AI Driven Strategies that are customized to your strategy parameters and specific investment setup.

Enterprise-Grade

Security

Protect your data and strategies with bank-level encryption, secure authentication, and compliance with financial regulations.

You don’t need

to become a quant shop.

You just need quant-grade support that fits your investment approach

SEKASA provides:

✔ Institutional-quality forecasts across asset classes

✔ Forecasts tailored to your investment strategies

✔ Flexible holding periods and signal frequency

✔ Risk and volatility models aligned with your goals

✔ Transparent insights behind every signal

Tailored AI Driven Insights for Financial Institutions

Family Offices

✔ Multi-asset forecasting for short- and long-term strategies

✔ Customizable Trading Bot Software to enhance and automate your strategies with AI

✔ Tailored risk management aligned with your investment philosophy

Asset Manager

✔ Quant-grade signals for equities, FX, Crypto, fixed income, and specific asset classes like emerging markets equities

✔ Integrates into your workflows, no internal quant team needed or as an addition to existing ones

✔ Backtested forecasts to align with your Strategy and Goals

Trading Platform Providers

✔ Trading signals for multiple asset classes to boost user activity

✔ Seamless API integration with your platform

✔ White-label forecasting tools to strengthen your brand

Professional Trading Companies

✔ Real-time AI insights on price, volatility, and momentum

✔ Custom models to optimize trading and hedging strategies,

like entry and exit point optimization

Your Investment Strategy. Enhanced by AI.

Book your

Quant-as-a-Service

Price Forecasting

Advanced AI algorithms predict asset price movements with industry-leading accuracy

✔ Equities, FX, commodities, fixed income, crypto

✔ Real-time updates

✔ Custom timeframes

✔ Risk metrics

Volatility Analysis

Comprehensive volatility modeling for risk management and trading strategies

✔ VaR calculations

✔ Stress testing

✔ Scenario analysis

✔ Portfolio optimization

Model Robustness Check

Custom quantitative analysis tailored to your investment strategies

✔ Factor modeling

✔ Backtesting

✔ Strategy development

✔ Performance attribution

API Integration

Seamless integration with your existing systems and workflows

✔ RESTful APIs

✔ Real-time feeds

✔.Custom endpoints

✔ 24/7 support

The Perfect Reason For Choosing Brandcraft.

Our agency collaborates closely with you, ensuring a deep understanding of your business.

Target Audience

Analyzing consumer behaviors, such as purchasing habits and decision-making processes.

High Conversation Rate

A higher conversion rate means more visitors are turning into paying customers.

Better Market Research

Market research offers insights into customers' price sensitivity and perceptions of value.

Looking To Expand Your Business?

Our agency takes a collaborative approach, working closely with you to understand your business objectives and simplify marketing solutions that align with your vision.

Over 2K+ Companies Have Grown With Our Agency

Our agency takes a collaborative approach, working closely with you to understand your business objectives and craft personalized marketing solutions that align with your vision.

Supported Asset Classes

Our AI models are trained on diverse financial data across multiple markets

Equities

Global stocks, indices, and ETFs

Commodities

Energy, metals, and agricultural

Crypto

Major

cryptocurrencies

Major cryptocurrencies

Forex

Major, minor, and exotic pairs

Fixed Income

Bonds, rates, and yield curves

Our AI-Powered Tool for Multiple Applications

AI Driven

Educational Signals

for Trading & Hedging.

Customized to Your Strategy Parameters

Customizable AI Driven Trading Bot Software

Combine Your Strategy Parameters with the Power of AI and Automation

AI Driven

Benchmarking Tool

for Portfolio Creation, Valuation & Price

Driver Analysis

Make Your Choice

Entry Package

Start With Proof:

Strategy Backtesting

Before full integration, SEKASA offers a dedicated backtesting service. We run our AI-powered forecasts against your strategies to demonstrate their impact on performance, risk, and volatility management.

Clear, data-driven validation of our forecasts

Apply to your own strategies before committing

Fee to be discussed based on your requirements

Result: Confidence in the quality and relevance of SEKASA’s

quant signals—before you move the big needle.

Full Integration

Institutional-Grade

API Integration

Once you’ve seen the proof, unlock the full power of SEKASA with a customized API integration tailored to your investment strategy and framework. Our team works hand-in-hand with your experts.

Direct API access to our price & volatility forecasts

Custom strategy alignment & support

Scalable, secure, institutional-grade delivery

Result: Clean, predictive quant data flowing directly into your models, platforms, or decision-making infrastructure.

Built for Institutions That Think Ahead.

What We Offer

SEKASA provides a quant-driven price forecasting tool for multiple asset

classes, tailored to your strategy and supported by dedicated managed

services for:

Investment and risk management

Seamless implementation

Long-term partnership

Why SEKASA Fin?

Our clients gain access to an institutional-grade, AI-powered trading

support tool, without building or maintaining their own quant

infrastructure.

No need to hire quant developers

No maintenance of model pipelines

No costly compute environments to manage

What You Get

AI investment support tool tailored to your investment strategy

Institutional-level quant driven investment signals & insights

Ongoing model updates & innovation

Smooth integration with brokers & internal systems

Cost-efficient. Scalable. Strategically aligned.

Make Your Choice

Entry Package

Start With Proof:

Strategy Backtesting

Before full integration, SEKASA offers a dedicated backtesting service. We run our AI-powered forecasts against your strategies to demonstrate their impact on performance, risk, and volatility management.

Clear, data-driven validation of our forecasts

Apply to your own strategies before committing

Fixed fee: €6,000 – €12,000 depending on scope

Result: Confidence in the quality and relevance of SEKASA’s

quant signals—before you move the big needle.

Full Integration

Institutional-Grade

API Integration

Once you’ve seen the proof, unlock the full power of SEKASA with a customized API integration tailored to your investment strategy and framework. Our team works hand-in-hand with your experts.

Direct API access to our price & volatility forecasts

Custom strategy alignment & support

Scalable, secure, institutional-grade delivery

Result: Clean, predictive quant data flowing directly into your models, platforms, or decision-making infrastructure.

Build Your Plan

Pick the asset classes you need and choose delivery frequency. Pricing is in EUR. One-time set-up plus monthly fee (billed annually).

Delivery Frequency

Assets

“Per Market” lines allow you to select how many markets you want included. Monthly fees are billed annually.

| Included | Qty | Set-up | Monthly |

|---|

All prices exclude VAT. Deployments are dedicated per client. Secure API delivery. No hidden fees.

SEKASA Technologies &

Leadership

SEKASA Technologies is founded by the two Germans Katharina and Sebastian in Cyprus and provides fully customizable, AI-powered trading and risk management tools for institutional clients. Our core product, SEKASA Fin, delivers quant-grade price forecasts and strategic signals, tailored to your portfolio, integrated via API, and supported through ongoing managed services. With SEKASA, clients gain access to cutting-edge quant capabilities without the internal complexity of building and maintaining an in-house team.

Sebastian Niehaus

Managing Director & Founder

As a quantitative researcher and machine learning expert, Sebastian Niehaus develops SEKASA’s forecasting models and infrastructure. He builds scalable systems that transform complex market data into reliable predictions, ensuring the technology performs under real-world financial conditions.

With a background in applied machine learning, quantitative modeling, and large-scale data engineering, Sebastian has worked across both academic and industry environments, focusing on time-series prediction, statistical learning, and the deployment of robust, production-grade ML systems. His experience enables him to bridge cutting-edge research with practical implementation as part of the SEKASA team.

Frequently Asked Questions

Is SEKASAs Tool a Plug and Play Tool?

Yes and no. SEKASA is not a one-size-fits-all solution, but it is built for seamless integration.

We adapt the tool to your specific strategy and infrastructure, then connect via secure APIs to your broker systems, risk tools, or trading dashboards, without requiring changes to your core setup.

What asset classes does SEKASA support?

SEKASA supports: Equities from several markets, Cryptocurrencies, Commodities (Futures and Spots), Forex, Fixed

Income and Illiquid Assets. Click here for a full list.

Can SEKASA integrate my internal Data?

Yes. SEKASA can integrate your internal data sources and create specific models based on your data.

What does customization mean in practice?

Customization means the tool adapts to you—not the other way around. We align forecasts, signal frequency, timeframes, asset coverage, and trading strategy logic to your specific needs, whether you're a family office, asset manager, or trading platform.

Will I have a dashboard?

No. SEKASA does not offer a standalone dashboard. Instead, we integrate directly into the systems you already use, such as trading desks, broker platforms, or internal information systems, so your team can work within their familiar environment.

How does the Integration work

All features are available via secure, well-documented APIs. We support full integration into broker systems, trading frontends, and internal risk dashboards. Our team assists during onboarding for a smooth setup.

How is the Pricing?

Our pricing is tailored to your needs and split into two phases:

1. Backtesting & Strategy Alignment // 2. Integration & Monthly License

Contact us for a custom offer.

Is my Data Secure?

Yes. We use strong encryption and offer on-premise options for full data control.

Address:

SEKASA Technologies Ltd.

Ellispontou 26

7100, Larnaca

Cyprus

Contact

Disclaimer

*SEKASA Technologies Ltd. provides algorithmic software infrastructure and AI-powered forecasting tools solely for informational and technical purposes. SEKASA does not provide investment advice, financial planning services, or recommendations regarding the purchase or sale of any financial instruments. The client is solely responsible for any investment decisions and the use of the software. SEKASA is not licensed as a financial advisor, broker, or dealer under any regulatory authority.

© 2025 SEKASA Technologies Ltd.

All rights reserved.

created by theaicolleague.com